Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

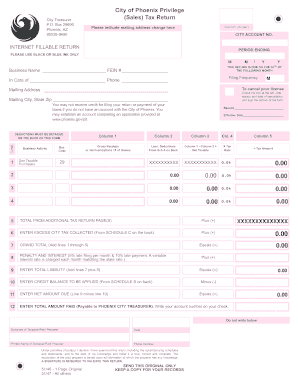

What is privilege sales return form?

A privilege sales return form is a document provided by a business to customers to facilitate the return of purchased items. It usually includes fields for customer information, item details, reason for return, and any additional comments or instructions. This form helps streamline the return process and ensures that customers provide all the necessary information for a successful return or exchange. The term "privilege sales" may refer to specific policies or benefits associated with certain customer groups, such as VIP customers or members of a loyalty program.

Who is required to file privilege sales return form?

The requirement to file a privilege sales return form may vary depending on the jurisdiction or country. Generally, businesses engaged in selling taxable goods or services may be required to file privilege sales return forms. This includes retailers, wholesalers, manufacturers, and service providers. It is advisable to consult the tax authority or seek professional advice in your specific jurisdiction to determine the requirements for filing privilege sales return forms.

How to fill out privilege sales return form?

To fill out a privilege sales return form, follow these steps:

1. Obtain the privilege sales return form. This may be available on the retailer's website, provided with the original purchase, or you may need to request it from customer service.

2. Start by filling in your personal information. Provide your name, address, phone number, and email address in the designated fields. Some forms may also ask for your account number or order number, so include those if applicable.

3. Next, provide details about the item being returned. Enter the item's name or description, along with any specific identifiers such as SKU or part number. If available, include the date of purchase.

4. Indicate the reason for returning the item. This could be due to defects, incorrect sizing, change of mind, or any other applicable reason listed on the form. If there is limited space to explain, try to be concise and specific.

5. Declare whether you would like a replacement, exchange, refund, or store credit. Follow the instructions on the form to make your selection. If a refund or store credit is desired, provide necessary details like your preferred payment method or store credit account information.

6. Review and double-check the completed form to ensure accuracy. Verify that all required fields are filled, and proofread for any errors or omissions.

7. Attach any supporting documents requested by the retailer, such as a copy of the original receipt or proof of purchase. This ensures accurate processing of your return.

8. Once you are confident in the accuracy of the form, sign and date it as instructed. Some forms may require a digital signature, while others may need a physical signature if mailing or hand-delivering the form.

9. Follow the return instructions provided on the form. This may involve mailing the form and item back to the retailer's designated address or dropping it off at a specific location.

Remember to keep a copy of the completed form for your records, along with any tracking numbers or postal receipts. This will enable you to track the progress of your return and serve as proof if any issues arise.

What is the purpose of privilege sales return form?

The purpose of a privilege sales return form is to facilitate the return or exchange of a product or item that was purchased through a privileged sales program or discount. This form allows the customer to provide the necessary information, such as the reason for return, date of purchase, and any other relevant details, in order to initiate the return process and ensure a smooth and convenient experience for both the customer and the seller.

What information must be reported on privilege sales return form?

The specific information that must be reported on a privilege sales return form can vary depending on the jurisdiction and applicable regulations. However, generally, the following information may be required:

1. Name and contact details of the seller or business

2. Date of the sales transaction

3. Invoice or sales receipt number

4. Description and quantity of the returned items

5. Reason for the return (e.g., defective product, incorrect item, buyer's remorse)

6. Sales price or purchase amount of the returned items

7. Any applicable taxes or fees associated with the original sale and subsequent return

8. Method of refund or credit requested by the buyer (e.g., cash refund, store credit, exchange)

9. Buyer's name and contact details (if not already provided)

10. Signature or authorization of the person completing the return form (seller or buyer)

11. Date of return request

12. Any additional terms or conditions associated with the return process as specified by the seller or relevant regulations.

It is important to consult the specific guidelines or regulations set by the relevant authorities or jurisdiction to ensure accurate reporting on privilege sales return forms.

What is the penalty for the late filing of privilege sales return form?

The penalty for the late filing of a privilege sales return form can vary depending on the specific jurisdiction and regulations in place. It is recommended to refer to the applicable tax laws or consult with a tax professional for accurate and up-to-date information on the penalties associated with the late filing of a privilege sales return form in your specific location.

How do I modify my privilege sales return form in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your privilege sales return form and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I fill out the privilege sales return form form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign privilege sales return form. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

Can I edit privilege sales return form on an Android device?

You can make any changes to PDF files, such as privilege sales return form, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.